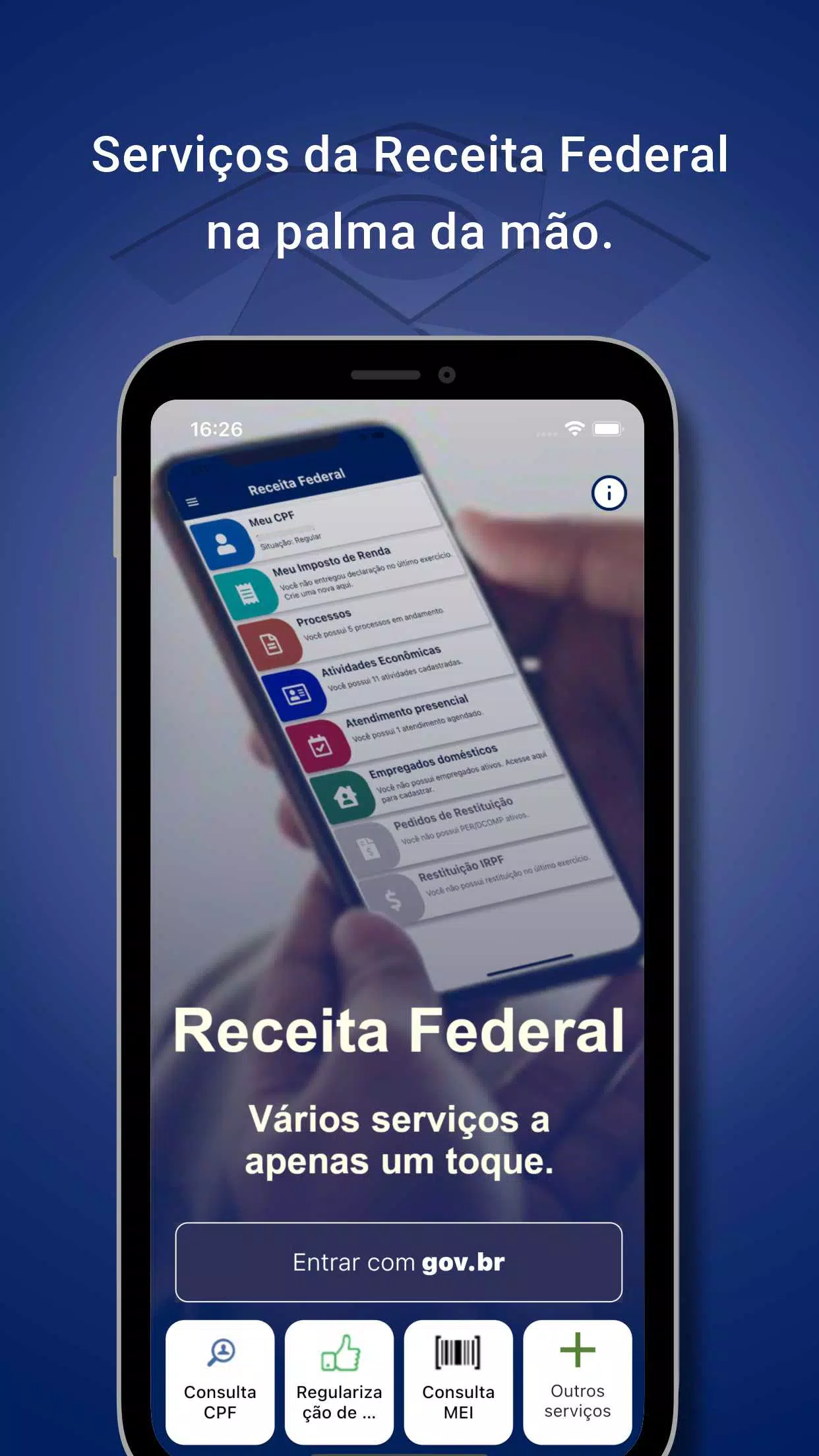

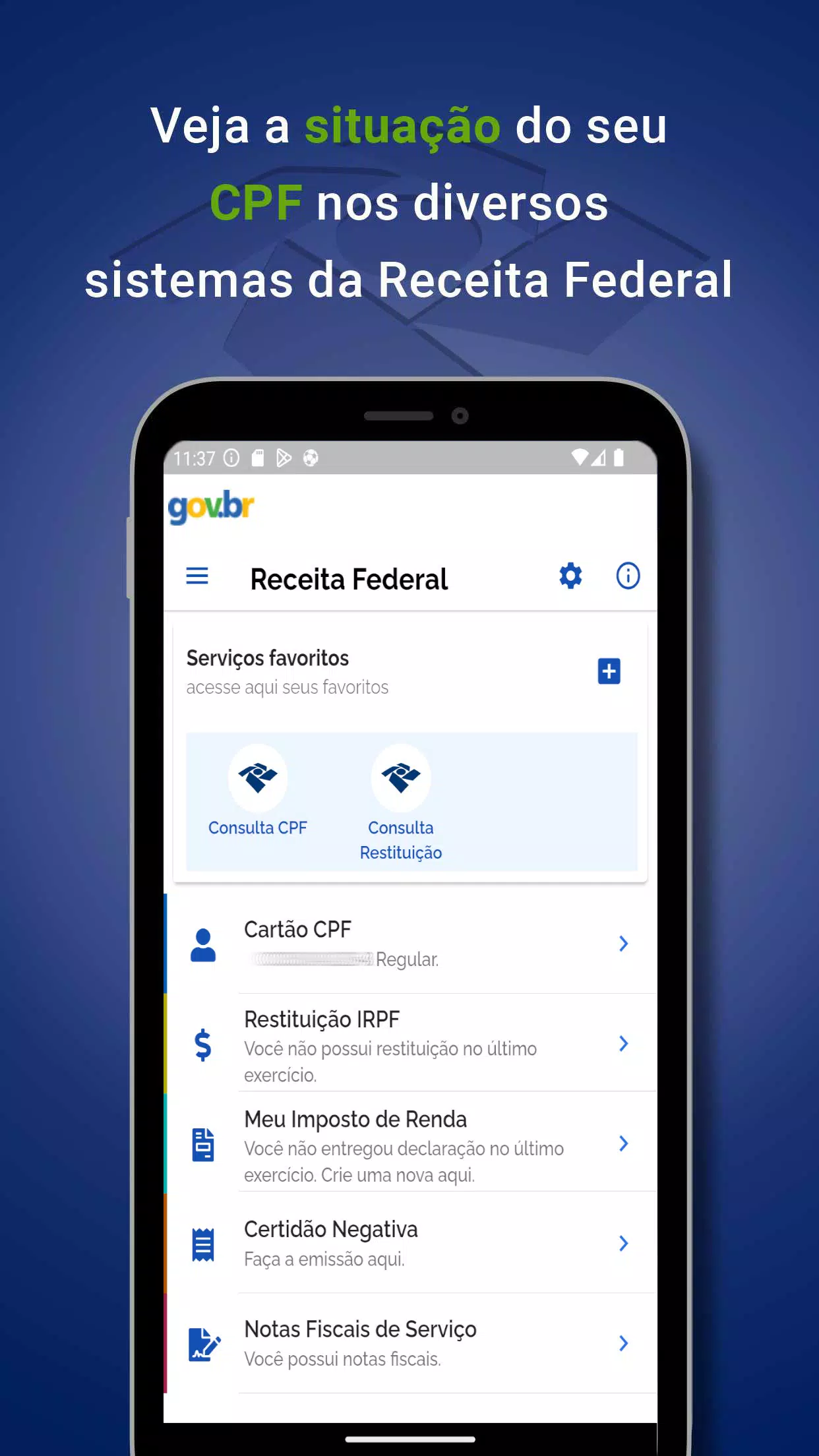

The Internal Revenue Service (IRS) provides a comprehensive platform for citizens to manage various aspects of their CPF (Cadastro de Pessoas Físicas) within different Federal Revenue systems. This user-friendly application simplifies the process of accessing important financial and tax-related information. Below is a detailed overview of the services and functionalities available through the IRS application.

Services Offered

The IRS application offers the following services, with some requiring the download of an additional Federal Revenue application, as indicated by an asterisk (*):

- CPF Card: Access your CPF card details directly within the application.

- Negative Certificate of Debts: Obtain a certificate indicating no outstanding debts.

- IRPF Refund: Check the status of your income tax refund.

- **Income Tax Declarations***: Manage and submit your income tax declarations.

- **Processes in Progress***: Monitor the status of your ongoing processes.

- Economic Activities – CAEPF: View your registered economic activities.

- **Schedules - SAGA***: Access your scheduled appointments and deadlines.

- **eSocial – Domestic Employees***: Manage information related to your domestic employees.

- **My Companies (including MEI)***: Access information about companies you are associated with, including Microempreendedor Individual (MEI).

- My Imports (Import Declarations and Bill of Lading): View details about your import activities.

- Refund Requests via PERDCOMP: Submit and track requests for refunds through PERDCOMP.

- Service Invoices: Access your service invoices.

- Health Recipe: View your health-related prescriptions and expenses.

Additional Consultations

In addition to the main services, the application allows you to consult various other details, such as:

- CNPJ registration

- MEI status

- CNAE (National Classification of Economic Activities)

- NCM (Nomenclature of the Mercosur Common Market) tables

- RFB (Federal Revenue of Brazil) Units

- Legal regulations

- Sicalc (Calculator for Social Security Contributions)

- Import simulation

- And many other services

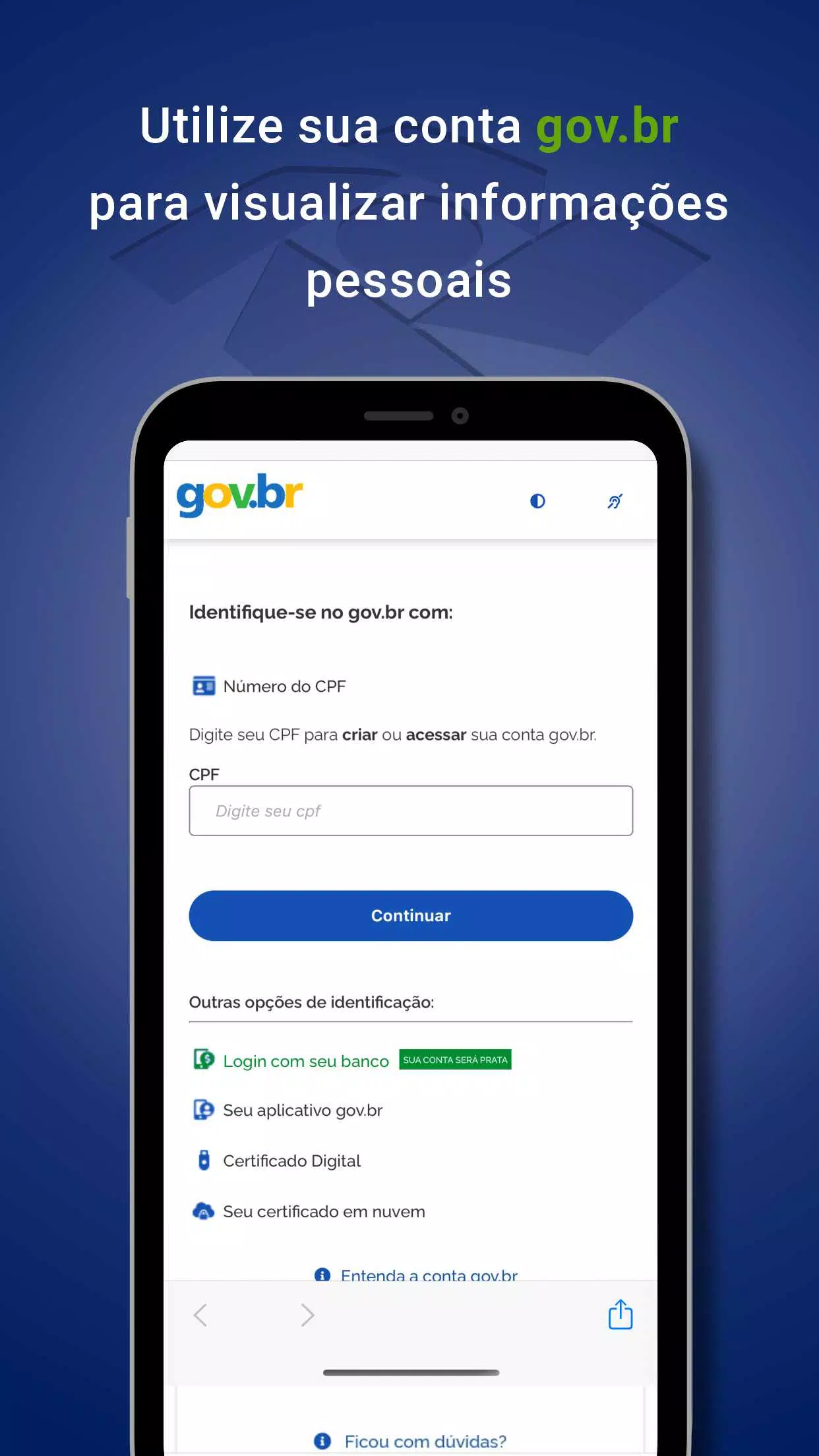

Query Access Levels

The application offers different levels of access depending on whether the user is authenticated through gov.br or not:

Unauthenticated Users (without gov.br):

- You can only access basic data.

- You cannot save favorites.

- Each query requires a CAPTCHA verification.

Authenticated Users (with gov.br):

- No CAPTCHA verification is required.

- You can save favorites for easy future access.

- You will soon receive alerts about any movements related to your queries.

2a. Third-Party Data:

- You can view basic information about third parties.

2b. Your Own Data (My Data):

- You have full access to your personal information.

By providing such comprehensive services and user-friendly features, the IRS application ensures that citizens can efficiently manage their financial and tax obligations with ease and convenience.